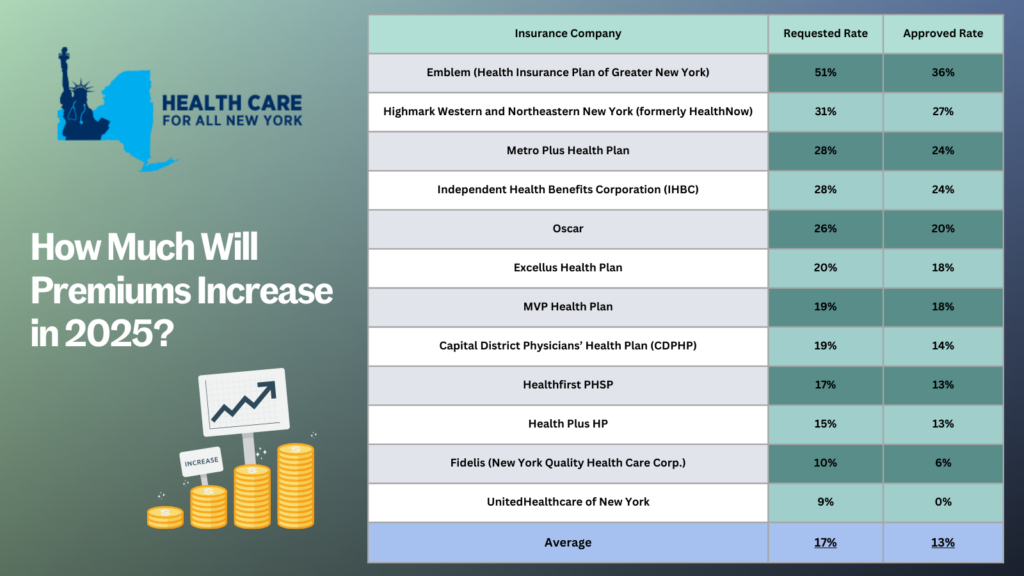

New Yorkers anticipating health insurance premiums in the individual market will face disappointing developments in 2025. The latest data shows that individual market rates are expected to increase by an average of 13 percent next year. Insurance carriers initially

requested a 17 percent average rate surge for 2025, but through New York’s prior approval process, the Department of Financial Services has marginally trimmed this figure down. The table below compares health plans’ initial rate requests with rates that were ultimately approved, providing insight into how this process impacts your healthcare costs (you can also review our detailed comments on each carrier’s rate request).

The prior approval process acts as an important safeguard; and while expanded advanced premium tax credits—enacted through the American Rescue Plan during the COVID-19 pandemic—have helped make health insurance more affordable, these tax credits are set to expire in 2025. This 13 percent increase will be a financial burden for many New Yorkers. New York should consider additional strategies to protect consumers from steep premium increases beyond the rate review process. States—such as Connecticut, Delaware, Massachusetts, Nevada, New Jersey, Oregon, Rhode Island, and Washington—have already taken steps in this direction, setting up Health Care Cost Containment task forces or agencies.

If you’re concerned about health insurance costs, there’s good news. Most New Yorkers purchasing their own health coverage are eligible for subsidies that can help. To explore your options and learn more about available subsidies, visit the NY State of Health enrollment site. If you need help switching plans or finding affordable health insurance, the Navigators program offers free, unbiased guidance and can help you understand your premium assistance and coverage options. You can contact Navigators through the CSS Navigator Network at 888-614-5400 or email enroll@cssny.org. Additionally, you can reach out to NY State of Health assistors online or by calling 855-355-5777.